Commonly used words collected from a social media sentiment analysis can provide insights on how South Carolina Internet users feel about the economy. (Social Media Insights Lab/Geri Johnson/Carolina News & Reporter)

A poll by the Pew Research Center found inflation topped Americans’ list of problems facing the country in 2024.

And while some of the best-known economic metrics don’t look great for South Carolina, some economists say a deeper look shows the state might be in a better position than it appears.

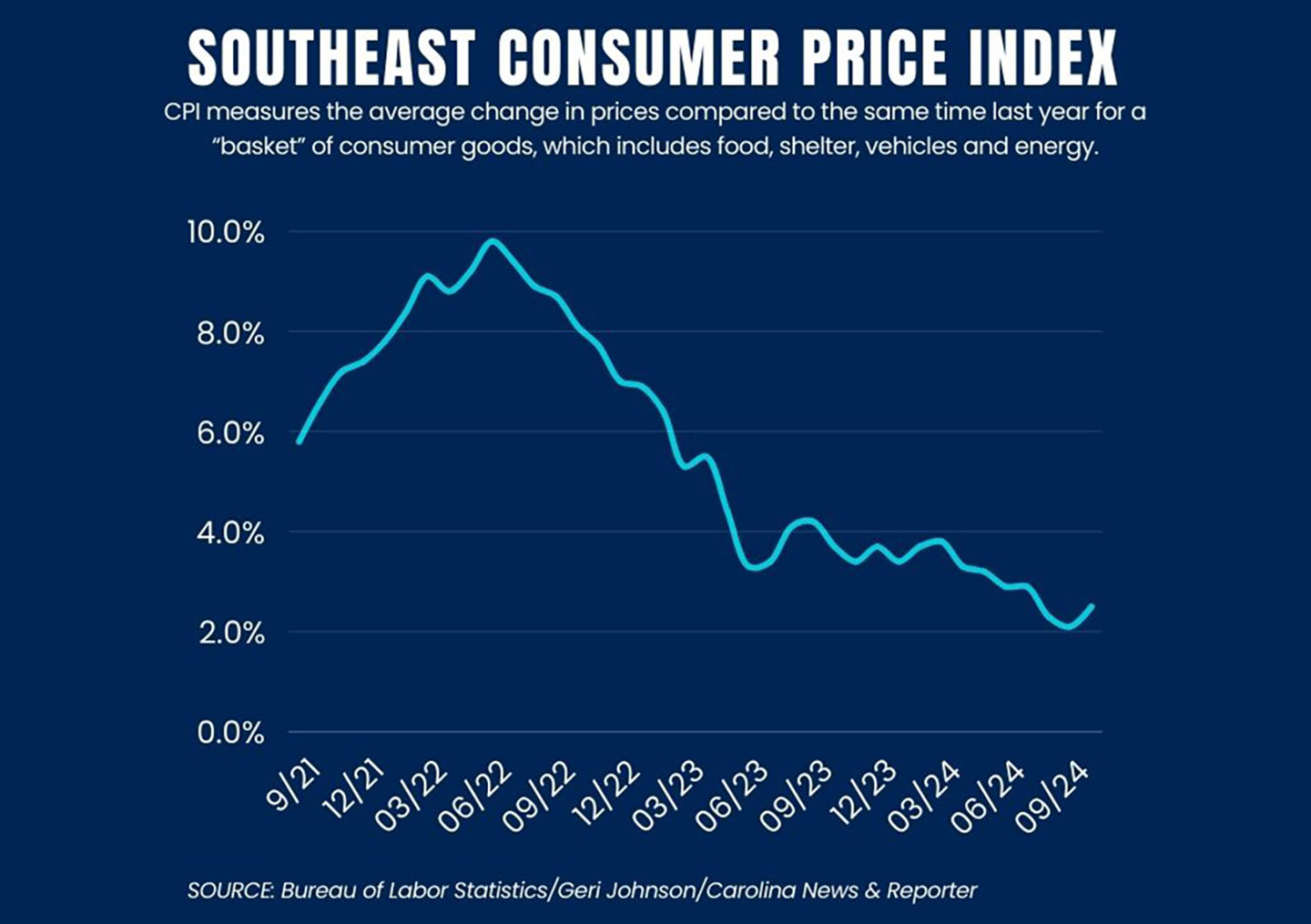

Inflation peaked in the Southeast at 9.8% in June 2022 compared with a year prior, when national inflation was at its peak. But the Bureau of Labor Statistics reported inflation was 2.5% in October 2024.

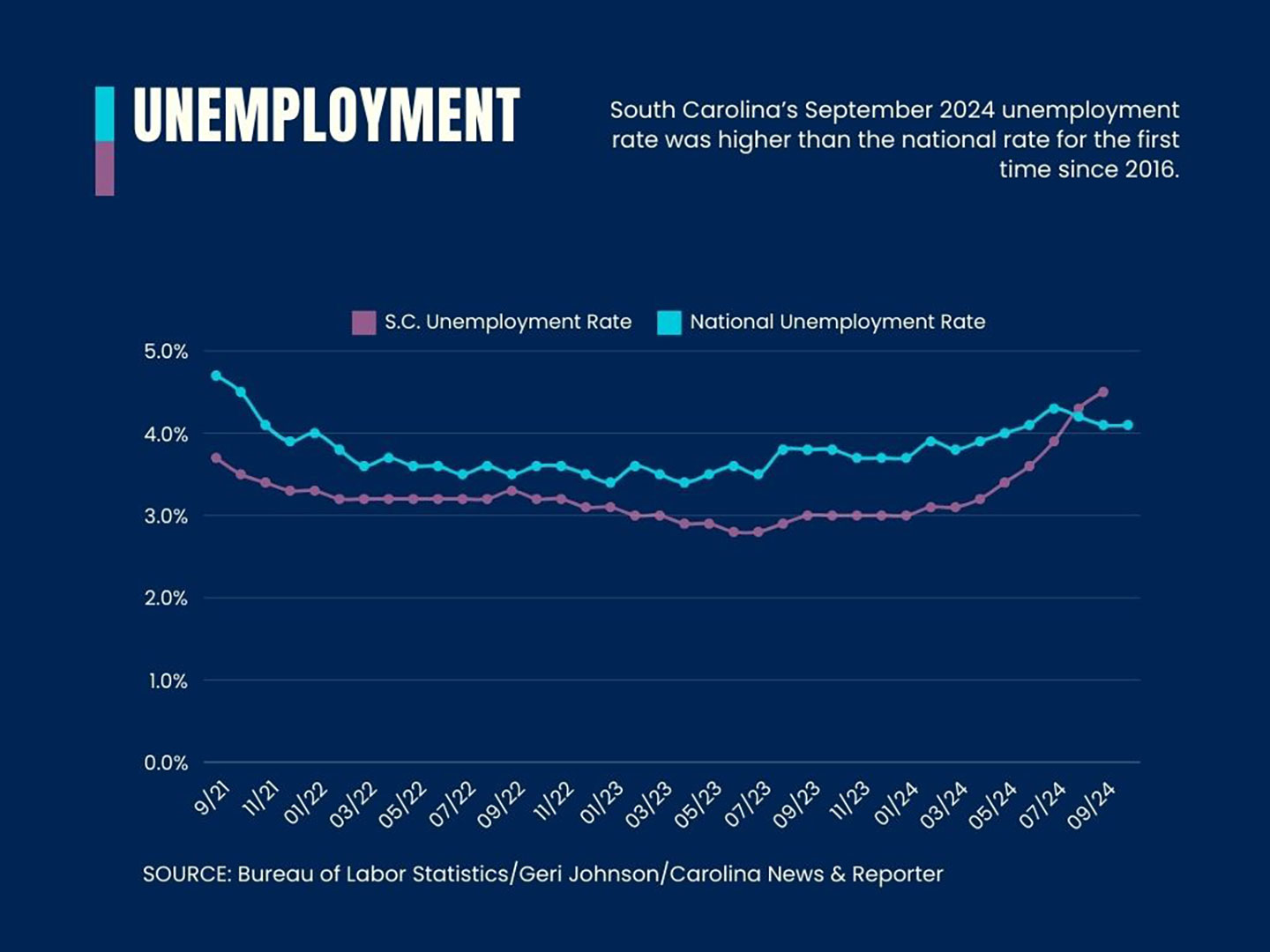

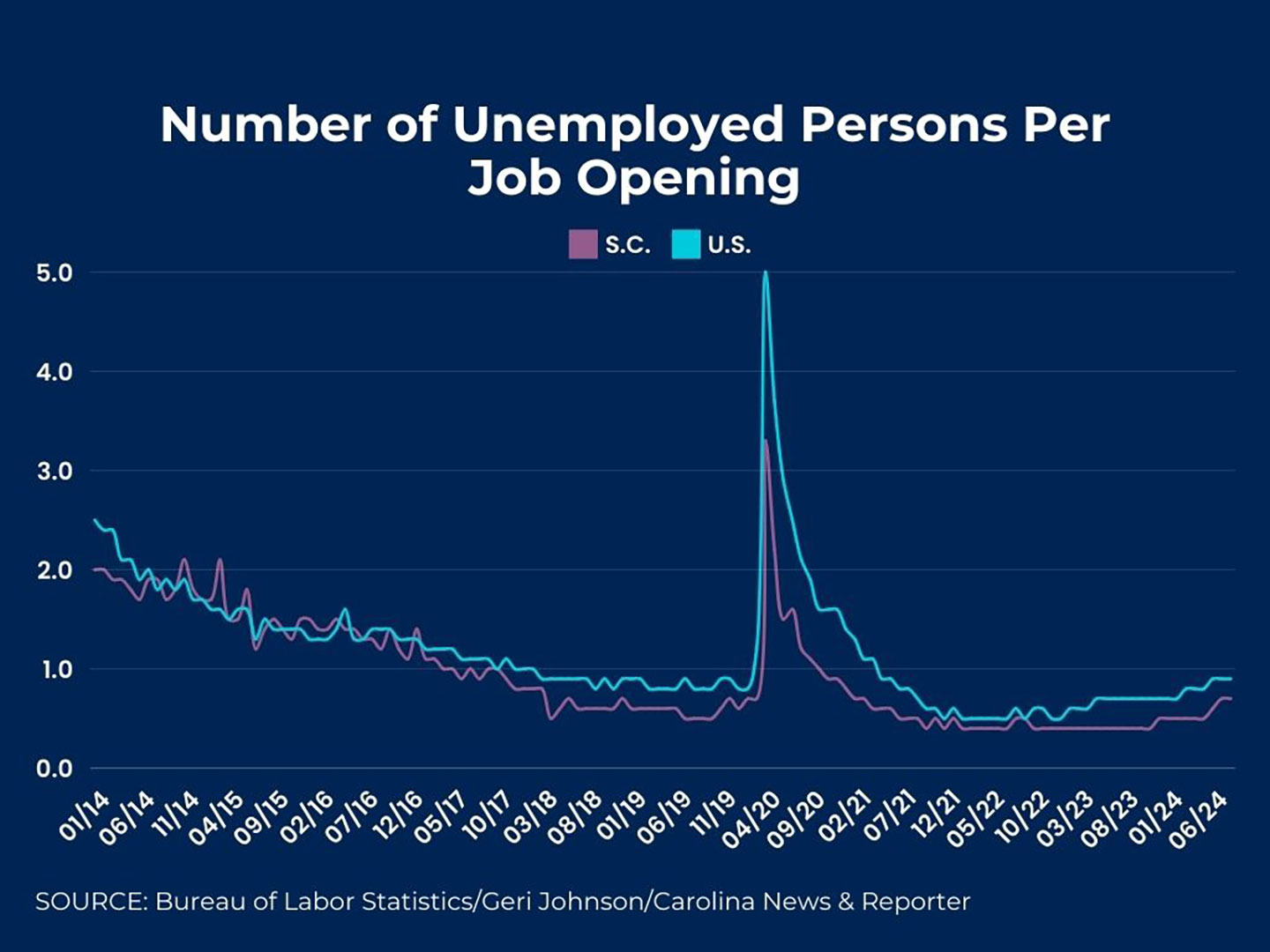

While South Carolina’s unemployment rate was 4.5% in September, there were more job openings available than those seeking employment.

Economist Joseph Von Nessen uses a speed limit analogy to describe the economy’s trajectory. Last year when inflation was high, the economy was going 80 miles an hour. Now, it has slowed to 65 miles an hour.

“We’re right where we need to be,” said Von Nessen, a research economist at the University of South Carolina. “We don’t want to accelerate back to 80 again; we just don’t want to slow any further.”

Economists say the state benefitted from a post-pandemic economic boom due to its strong tourism industry. Tourism expenditures in the state increased 39% from 2018 to 2022, according to an analysis done on behalf of Discover South Carolina by research and consulting firm Beacon Economics.

S.C.’s relatively low prices (it’s ranked No. 44 in overall cost of living by a Forbes Advisor analysis) and the state’s 187 miles of coastline made S.C. an attractive destination for visitors looking to enjoy a vacation.

But Americans weren’t just visiting S.C. — They were also moving to the state in droves. The U.S. Census Bureau estimates the state’s population grew 5% in the three years following the onset of the pandemic.

This year has seen a steady increase in unemployment in South Carolina, jumping from 3% in January to 4.5% in September. But that might not be as bad as it sounds, according to Bryan Grady, an economist and assistant executive director for workforce development with the S.C. Department of Employment.

“There is a substantial increase in individuals choosing to join the workforce,” Grady said. “Job openings are still well above pre-pandemic levels, and there are far more available jobs than unemployed people.”

Despite some positive economic metrics, many locals are still suffering. Von Nessen pointed to inflation as the reason why.

“Consumer sentiment still remains relatively low compared to where it was before the pandemic began,” he said. “Many consumers are feeling financially squeezed, and that makes it hard to feel good about an economy.”

Post-pandemic inflation: Prices up, purchasing power down

Converse University economics professor Madelyn Young said the inflation Americans experienced in 2022 was a “best-case scenario.” Demand-side inflation happens when consumers demand more — so while demand-side inflation leads to price increases, it also means that consumers are spending, and employers are creating jobs.

“The economy looks good from the traditional measures,” Young said. “But different groups are going to experience different outcomes.”

USC economics professor Orgul Ozturk said the pandemic unevenly affected different groups.

“COVID worked out great for, you know, higher-income individuals,” Ozturk said. “But how is the person who’s cleaning our offices doing? They’re not doing that great.”

Post-pandemic inflation peaked in the Southeast in June 2022 at 9.8%, the highest rate since the early 1980s. Inflation has slowed this year, rising to 2.5% in October compared with a year earlier. Bur wages have not risen at the same rate that prices have — especially for lower earners.

“Real wages overall are pretty stagnant,” Ozturk said. “But when you look deeper and look at it by group, you see the higher skilled, white-collar and highly trained are doing so much better. The polarization is striking.”

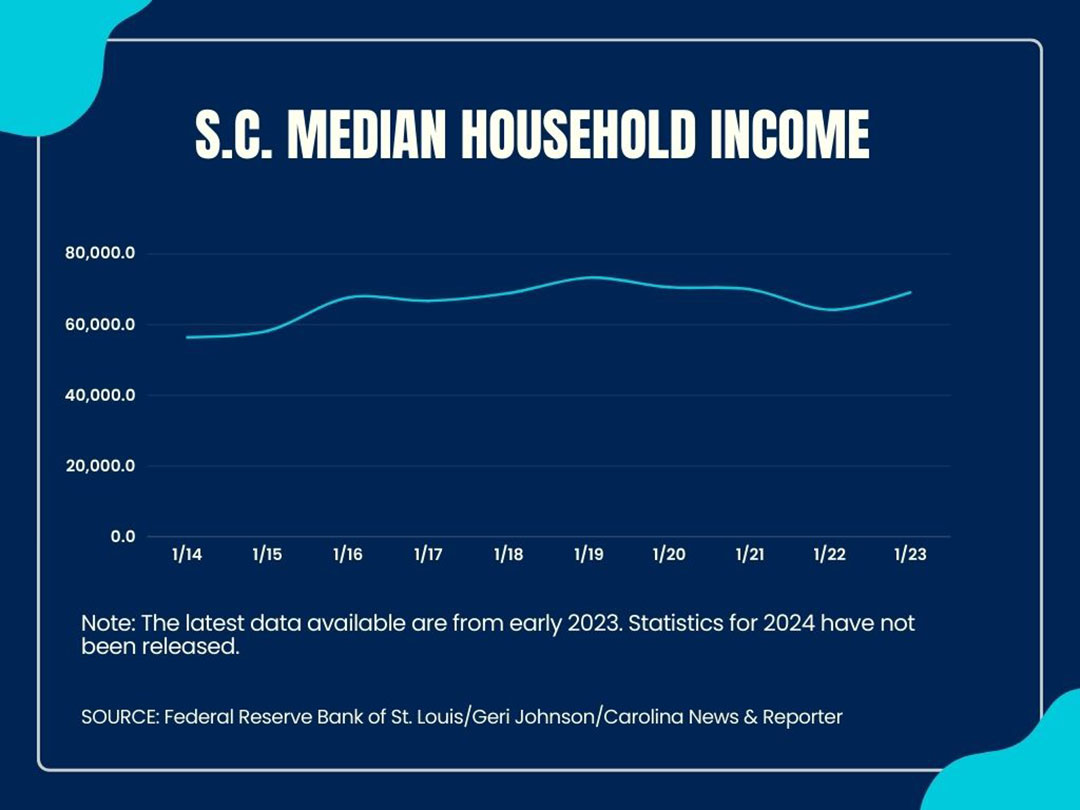

South Carolina’s median household income has risen about 18.5% in the past decade, according to statistics from Federal Reserve Economic Data (FRED), an organization that compiles national economic data. But the spending power of the dollar has taken a major hit. According to the Bureau of Labor Statistics, spending $10 in 2014 is equal in worth to $13.29 in 2024.

Sue Berkowitz, an attorney and director of policy at SC Appleseed Legal Justice Center in Columbia, said that high inflation has a major effect on South Carolinians.

“Even if you’re making $10 an hour, which is substantially above the minimum wage, the purchasing power is not nearly what it was,” Berkowitz said.

Ozturk said this loss of purchasing power leads to negative views of the economy, something that surfaced in national polls before the recent presidential election.

“Levels of prices are much higher, and it is quite salient to everyday people because the biggest increases we see are on the grocery store aisles,” Ozturk said. “If I am seeing all the negative effects on the grocery prices, but my wage is not increasing enough to catch up with the prices … my economy is not growing.”

Cost of living, housing and healthcare

The average price of a house nationally in 1963 was $19,300 according to FRED. If home prices had stayed consistent with inflation, the average price today would be a little over $200,000.

In 2024, the average home price is $501,000.

While South Carolina’s median household income has risen 18.5% in the past decade, FRED statistics show the median house price listing has gone up 32%.

Berkowitz points to the state’s population growth as the reason why.

“If you look at the way people moved during the pandemic, a lot of people moved from really expensive areas to places in South Carolina,” Berkowitz said. “That has really made costs go up.”

Bernie Mazyck, president and CEO of the South Carolina Association for Community Economic Development, said this especially hurts low-income residents.

“Housing continues to be a challenge because the places where the jobs are, usually there’s a lack of affordable housing,” Mazyck said.

Mazyck said rising house prices can push locals out from their own neighborhoods.

“The growth is causing gentrification of a lot of marginalized and low-income, low-wealth communities,” he said. “Growth is good, as long as policymakers ensure that people who grew up in those communities can stay in those communities.”

Housing costs are not the only issue facing low-income South Carolinians. Berkowitz said healthcare and childcare prices can be enough to break the budget for a lot of residents.

“If you are turning your entire paycheck over for childcare, and not even maybe the best childcare, then you may have to make an economic decision that you just can’t afford to work,” she said.

One metric often used to measure economic success is job growth. Berkowitz said S.C.’s efforts to boost jobs work better elsewhere.

The state is spending $1.3 billion in taxpayer dollars to incentivize Scout Motors to bring its electric vehicle plant to Blythewood. The company expects to create 4,000 jobs.

“But we don’t have money to expand Medicaid for 300,000 people,” Berkowitz said. “How do we expect people to work if they’re not healthy?”

South Carolina’s economic future

As South Carolinians look ahead to 2025, many are uncertain about their financial futures.

In mid-October, Von Nessen said economists were not predicting a recession. He expects the next year to look a lot like this one, with cooling inflation and a less demanding job market.

However, economics played a major role in the outcome of the 2024 presidential election.

Ozturk said the high inflation Americans faced during the Biden administration led to an unfavorable view of Vice President Kamala Harris’s ability to handle the economy.

“When you are the government with high inflation, even if it is not your own doing, you end up bearing the burden of it,” Ozturk said. “It is always the case when an incumbent is facing really high inflation.”

President-Elect Donald Trump has argued that an increase in tariffs would balance out tariffs imposed by other countries. He plans to impose tariffs to incentivize companies to bring manufacturing to the United States.

Young said she worries those tariff increases will cause inflation to flip to the supply side, causing problems for the rest of the economy.

Supply-side inflation happens when costs for raw materials go up. If consumer demand remains unchanged, price increases are passed on to consumers. That leads to higher prices, but unlike demand-side inflation, production goes down and unemployment goes up.

“With Trump in office, if he follows through with increasing tariffs on things, you bet inflation is going to go up,” Young said.

Mazyck said on the local front, South Carolina’s economic problems can be solved with direct investment into communities.

“Our state’s main strategy around economic development is recruiting large corporations to the state,” he said. “We’re trying to convince policymakers to also make available resources to grow economies in local communities, which will make jobs and wealth building more easily accessible.”

Ozturk said such policy changes are vital to make the state’s economic growth sustainable.

“If we are just thinking about policy for the next day, what about the next generation?” she said. “What about tomorrow? Twenty years down the road? If we really want to be in a better place in 20 years, we need to have much different policy discussions.”