Personal credit card debt reached an all-time high at $1 trillion in early August. (Chris Newman/Carolina News and Reporter)

As Americans’ personal debt rises, financial advisors are warning people to limit their debt and avoid predatory loans.

TransUnion’s quarterly report in May showed the total unsecured personal loan balance throughout the United States hit $225 billion, up from $178 billion in 2022.

Experts say people with high amounts of debt and facing financial instability should avoid loans that take advantage of desperation.

Most commonly, experts say consumers find themselves in financial pitfalls by racking up more traditional debt through credit cards with high interest rates.

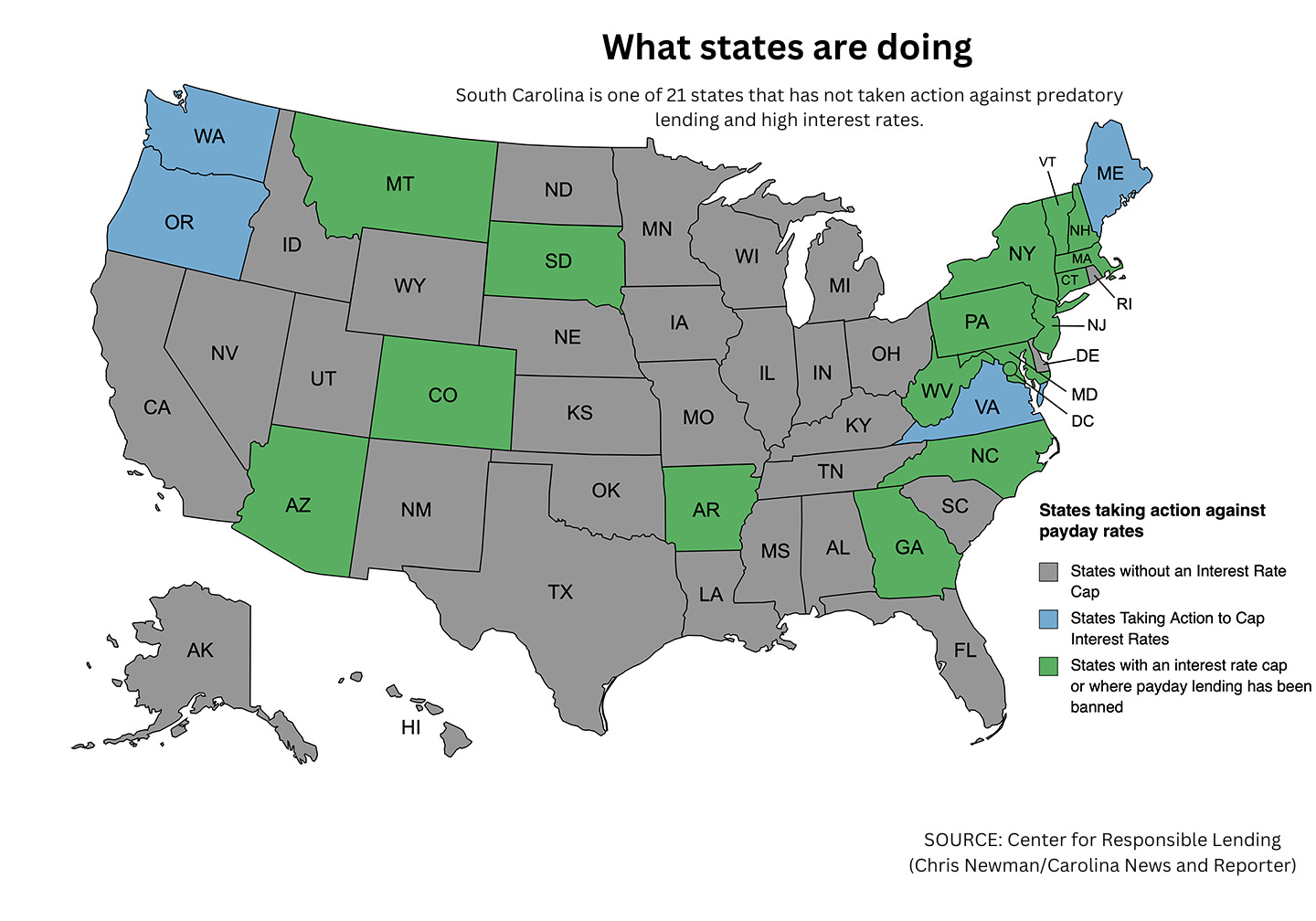

South Carolina is one of 21 states that has not taken action against payday lending and high interest rates as high as 36%, compared to its neighboring states of Georgia and North Carolina.

Columbia-area financial advisor David Grookett of Milestone Wealth Advisors said credit card companies target young people as well.

“As soon as they see you have credit history as a student, they throw credit cards at you,” Grookett said.

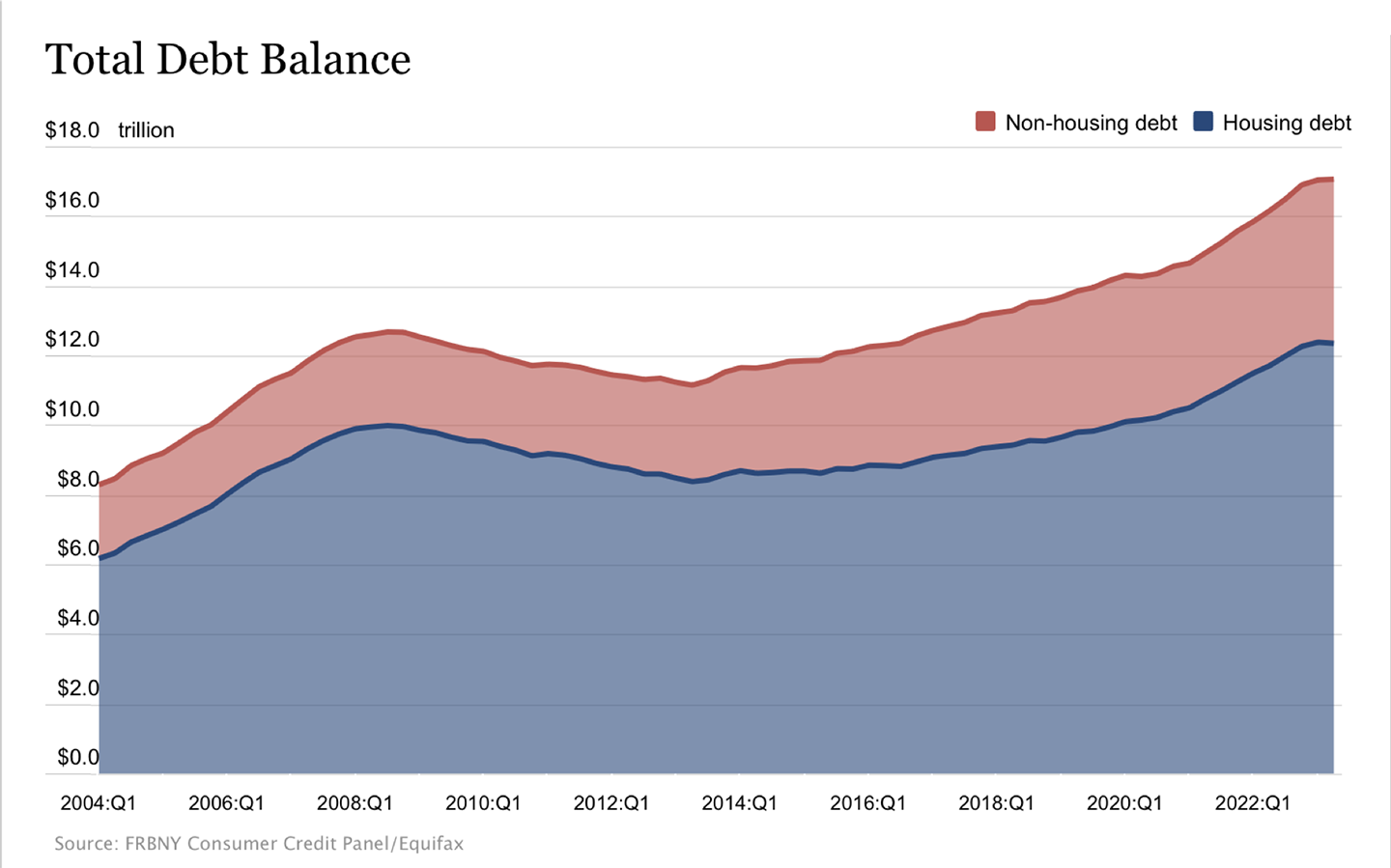

Credit card debt reached an all-time high at $1.03 trillion in the beginning of August, according to the Federal Reserve Bank of New York in its quarterly report on credit card and household debt.

The fine print

More than 5 million American families each year pay a total of $3.4 billion in fees on payday loans they receive as advances on a paycheck, according to the Center for Responsible Lending.

Some lenders are looking to trap clients into a loan they can’t pay off, said Richard Graham, a senior debt consultant at Freedom Financial, located in California.

He said compound interest loans are offered by quick loan companies that sometimes hide high interest rates behind the promise of cash.

A compound interest loan is a loan in which you pay off the original amount borrowed and pay interest that adds up over time.

The compound interest could carry over weeks, months or years based on how much time a person is given to pay off the loan. That’s compared to a simple interest loan that has a set interest rate paid on top of the principal.

According to SC Appleseed Legal Justice Center, S.C. title loan companies will write a loan for 30 days with 25% interest a month. On a $1,000 loan, the interest would be $250. Paying the $250 during the month of the loan means someone still owes $1,250 the next month, if they don’t completely pay off the loan. That keeps people in a cycle of only being able to pay the interest.

Credit cards can be another dangerous source of borrowed money, Graham said.

“Use of credit cards over time without paying it back in full causes your balance to go up and your credit score go down and your interest rates go up,” Graham said. “So, you end up paying more for those items you couldn’t afford in the first place.”

Graham said credit cards should only be used for two reasons: for purchase protection and for promotions, such as mileage bonuses and cash card bonuses.

“It is not meant to buy items you cannot afford.” Graham said. “If you do that, you’ll fall into that trap.”

Car loans can be the worst.

“The most predatory loans I’ve seen are car title loans,” Graham said. “They say it’s 7% interest, but it’s a simple compound loan, so it’s really 7% daily. Simple compound loans like car title loans are crazy predatory lending instruments.”

Grookett and Graham say it’s easy for loans to get out of control.

“I know there is a need, but it should be as limited as possible,” Grookett said. “Take these credit cards, for example, they snowball people into so much debt, and they’re so easy to get.”

Everyone should save their money in different accounts for different reasons, Grookett suggested. Set up savings accounts for goals, such as buying a car and emergencies.

“The earlier the start, the way better off you are,” he said. “Younger people have an advantage because they have time.”

Collateral loans

Pawn shops are a way for people to borrow money without using or damaging their credit.

But those who exchange their items, short time, for a fraction their value could be at risk of losing their possessions.

Decker’s Jewelry and Pawn on Decker Boulevard in Columbia has been offering loans to people for more than 32 years.

“It’s very easy to get a loan,” said Carol Simon, the shop’s co-owner. “You don’t have to go through 30 days of paperwork and get approved.”

These short-term loans can be paid off in a single payment or last three months, charging the principal plus a fixed interest rate. Borrowers are using collateral to get a loan, so they’re at risk of losing their collateral.

If they repay the loan amount, plus interest, they get their item back. Otherwise, the pawn shop ends up with something with more value than they paid.

“A lot of people don’t have the credit to open a credit card or bank account, let alone get a loan,” Simon said.

The pawn shop has its own sort of credit, allowing more money to be borrowed each time a customer pawns and reclaims a particular item.

If someone were to pawn an item for $100 dollars and reclaim it, for example, the next time they pawn it, they could get $110. It’s a growing bridge of trust between the lender and the client, Simon said.

“Other loans do credit checks and all of that,” said Aaron Rudolph, a customer at Decker’s. “I don’t care to do that.”

But if someone just wanted to sell their item, they would get more by selling it privately online.

A used video game system that would sell on eBay for a couple hundred dollars might sell for a fraction of the value at a pawn shop.

The only trade-off is the time it would take to sell the item online.

“It’s just more convenient for me,” Rudolph said. “It helps me get to my next paycheck.”

This way of getting a loan should be a last resort because some pawn shops charge a higher interest rate than others, Grookett said.

If you’re struggling or in debt, you should try to budget your life as much as you can, Graham said.

“Go in together” on purchases, Graham said. “Crowdfund stuff. It’s something a lot of people are doing right now. Buy bulk food between everyone in the household so you can budget and still eat every day.”

While Graham warns against taking on bad debt, he said people can help protect themselves from sticky situations by being diligent on the front end.

That includes budgeting wisely and being sure to live within your means, he said.

Total personal debt in the United States is on pace to reach $18 trillion. In 2023, non-housing debt reached $4.71 trillion. (Chris Newman/Carolina News and Reporter)

Decker’s Jewelry and Pawn has been in business for more than 30 years. Pawn shops do not require a personal credit history to receive a loan. (Chris Newman/Carolina News and Reporter)