The Financial Aid and Scholarships Office at USC is encouraging students to complete the form for student loan relief plan. (Photo by Jade Crooks)

The student loan debt forgiveness plan that President Biden announced in late August has hit some roadblocks, but local colleges are urging students to fill out the loan forgiveness application regardless.

One of the roadblocks stopping South Carolinians from receiving student loan relief is from their own state government.

South Carolina is part of a coalition of six Republican-led states that took legal action against the Biden administration Sept. 29 to block the aid. The other states besides South Carolina joining Arkansas in the suit are Kansas, Missouri, Iowa, Nebraska, according to the Associated Press.

The student loan relief plan was temporarily blocked in late October by the 8th Circuit Court of Appeals. The relief plan will stay blocked until the court decides whether to issue an injunction against the plan, according to an order issued by the court.

The reason for the lawsuit from the coalition boils down to money.

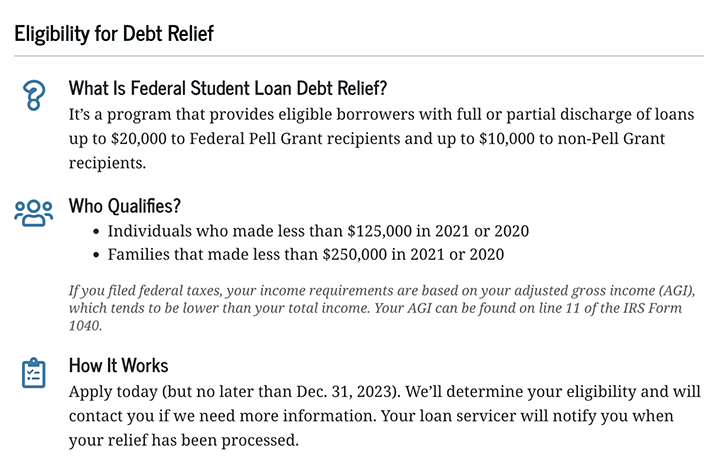

One of the coalition’s arguments is that the plan will cause state-associated Federal Family Education Loan Program agencies to lose revenue, according to a recent article by Forbes. The plan would cancel $10,000 in federal student loan debt per person and up to $20,000 if a person qualified for Pell Grants during college.

Though federal loans have not been available to people since 2010 when the program was replaced with the Direct Loan program, 11.2 million people still owe a combined total of $248 billion in the earlier federal loans, according to the Education Department.

The S.C. Student Loan Corp. used to administer the federal loans, and as a result, is also owed outstanding money from those loans, said Whit Ashley, a former employee of the corporation.

“Under the old program, it was the state lenders who originated the loans,” Ashley said. “… Now, under the direct loan program, the federal government is the originator. … So the loan companies like (S.C. Student Loan Corp.) still have these old loans on their books, and they’re still collecting on them because they’re the ones who loaned out money.”

But even if some attorney generals used this reasoning for the lawsuit against the student loan relief plan, the Biden administration’s attorneys have argued that it’s a moot point. That’s because the Biden administration changed the rules for the loan relief plan Sept. 29 to remove the earlier federal loan program more than two weeks prior to the appeal from the coalition.

Even with the legal proceedings ongoing, the U.S. Department of Education said people who have federal student loan debt still can submit applications. People who make less than $125,000 a year or married couples who make less than $250,000 a year qualify for the relief initiative, according to the department’s website.

If the courts rule in favor of the Biden administration, the education department has said it will be able to quickly approve the applications of people who filed in the meantime.

The University of South Carolina is telling students to go ahead and fill out the application.

USC’s Office of Financial Aid and Scholarships sent an email to Gamecock Guarantee students, or first-generation students from South Carolina, to remind them to fill out the application, even though “debt discharge is currently paused due to litigation.”

Ashley Pickett, the assistant director of financial aid at Benedict College, a historically Black college in Columbia, said it is encouraging students to apply now for the program, too. But the school hasn’t told students about the program getting tied up in litigation.

“We probably want to wait until everything is cleared before we send out any more communication,” Pickett said. “If we get any new information concerning the application, we will send out communications.”

To fill out an application and get more information, click here.