Low supply of consumer goods, including cars, coupled with high demand is causing inventory to turn over quickly and at a high cost. This month, the average number of days a new vehicle sits on a dealer lot before being sold is projected to fall to a record low of 20 days. Photos by Connor Hart

U.S inflation hit a three-decade high in October, as the average price of consumer goods and services continued to rise due to global supply shortages and increased consumer demand.

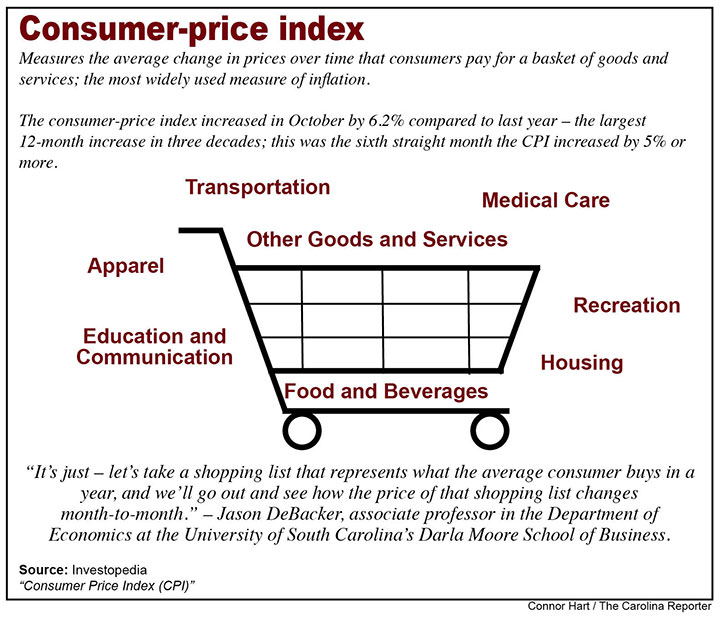

The U.S. Bureau of Labor Statistics said the consumer-price index, a standardized measure of the average cost of consumer goods and services, increased in October by 6.2% compared to last year. This was the largest 12-month increase since November 1990.

Nearly every sector saw an increase in prices. Notably, the cost of new vehicles and used cars and trucks rose by 9.8% and 26.4%, respectively, and the energy index rose by 30.0%.

“The question is: Is (the inflation rate) big or small? And I think the answer is, it’s big or small depending on if consumers notice it,” Jason DeBacker, an associate professor in the Department of Economics at the University of South Carolina’s Darla Moore School of Business, said. “Right now, if we look at consumer surveys, people are noticing this, and it’s affecting them.”

Supply chains are currently dealing with an increase in consumer demand as Western countries experience fewer effects from the COVID-19 pandemic and stronger economic recovery efforts. However, Eastern countries – major manufacturing hubs for consumer durables such as Japan – have only recently began to feel relief from the ongoing pandemic and are still dealing with labor shortages, high shipping costs and outbreaks of COVID-19.

These complications have resulted in supply chain disruptions and bottlenecks, causing global supply shortages of consumer goods such as new vehicles.

Toyota Motor Corp. expects a reduction of approximately 45,000-55,000 vehicles in November, a representative from the company wrote in an email.

Simultaneously, this month, the average number of days a new vehicle sits on a dealer lot before being sold is projected to fall to a record low of 20 days, according to a joint forecast from J.D. Power and LMC Automotive. This is down from 49 days a year ago and down from 23 days in September 2021.

The same forecast projects the average transaction price of a new vehicle to reach a record high of $43,999, an almost-20% increase from October of last year.

Similar struggles are facing the oil industry. Consumer demand for oil has rapidly increased as the effects of the COVID-19 pandemic has eased and people return to work, traveling and more; however, oil production dropped off drastically at the onset of the pandemic and has been slow to pick up, lowering the supply of oil and increasing its scarcity and cost, according to reporting done by Axios.

Dominion Energy, one of the leading energy providers in South Carolina, has been “impacted by international supply chain issues, as are other companies worldwide,” and the company is “taking proactive steps to minimize the impact of these challenges,” a representative of the company wrote in an email.

Drastic increases in the rate of inflation and ongoing disruptions to the global supply chain have caused many consumers to worry whether these changes are temporary or the signaling of a new normal.

Jason DeBacker, who researches the effects of taxation and politics on the economy, said policy makers, such as bankers at the Federal Reserve, are trying to determine the severity and permanence of the increased rate of inflation as well.

“There’s at least a couple – you know, just how prices are moving right now and how the data is collected, that point to this being a temporary thing,” DeBacker said.

For one, DeBacker said, the cost of consumer durables, such as cars, is rising at a much faster rate than the price of services, and that is because consumer durables are more affected by supply chain disruptions.

“The other piece to the puzzle here, with respect to why we can see a temporary blip that’s showing relatively high inflation, is because when we’re looking at these numbers, it’s a year-over-year change. So, you’re comparing October 2021 to October 2020, and last year we saw prices rise much, much more slowly than we’ve seen over the last decade,” DeBacker said.

The inflation rate was historically low throughout 2020. In May 2020, during the midst of lockdowns and closures caused by the COVID-19 pandemic, the inflation rate was 0.1%. In August 2020 the inflation rate was 1.3%.

Finally, these price increases are occurring worldwide, directly correlated to the global supply chain.

“(Other countries) have seen growth in their money supply in the last 20 months, but not to the extent we have in the U.S.,” DeBacker said. “So, this suggests all these countries are seeing price increases much higher than they’ve seen in the last 20 years. We’ve all had different monetary policy, but we all face that same global supply chain.”

Toyota Motor Co. expects a reduction of approximately 45,000-55,000 vehicles worldwide in November, a representative from the company wrote in an email to Carolina News & Reporter.

East Asian countries – such as Japan, where Toyota is headquartered – are major manufacturing sites for consumer goods. Many of these countries are struggling with labor shortages, high shipping costs and outbreaks of COVID-19, causing disruptions to the supply chain. Photo courtesy of Toyota Motor Co.

Dominion Energy is a major provider of energy in the state of South Carolina. Energy is produced at a power plant located in Cayce, South Carolina.