The fintech revolution is here.

If you’ve ever used Venmo to pay back a friend after a coffee date, deposited a check on a banking app, used Credit Karma to file your federal tax returns, or used PayPal to shop on your favorite e-commerce site, you are a part of the digital finance revolution.

Cheyenne Kirby of Olar has seen her mother, Carol Kirby, who’s a nurse practitioner, use PayPal to shop online several times.

“It makes things faster, with PayPal. It already knows your info, so with websites that use it, instead of having to go through those pages of billing addresses and such, you just put in your PayPal and it’s a lot easier,” Cheyenne Kirby said.

Sitting at the intersection of finance and technology, fintech improves the delivery and use of financial services from mobile banking to cryptocurrency and investment apps.

According to Forbes, Fintech is one of the hottest emerging industries, providing consumers and businesses alike with financial technology services.

The latest fintech trends

Digital-only banks — Influenced by mobile banking, banks with no brick-and mortar branches are increasing in popularity, particularly among millennials. Phone apps allow for money management while on the go.

Artificial intelligence (AI) — AI can automate data analysis, saving time and money. AI is also used to create chatbots to assist with customer service. It can also be used to detect fraud by motoring patterns of customer behavior.

Biometric technologies — This system helps prevent cyber attacks as well as helping to make logging in to an app easier and faster.

Number of fintech companies globally:

Americas — 5,779

Europe, Middle East and Africa — 3,583

Asia and the Pacific region — 2,849

This year may be the biggest year for fintech, with dozens of companies reaching billion-dollar validation. This industry has increased in recent years, with U.S. fintech companies raising $12 billion in funding – up 43% from 2017. To add to that, the global mobile payments industry is reportedly set to surpass $1 trillion this year.

There are several categories in the financial technology market and a lot of competition. Here’s a breakdown of the major categories that are being used today.

Lending

Financial technology companies are changing the lending process. People no longer have to go to banks or credit unions to borrow money. Many companies are now making loans directly to their customers.

Users can now request loans online from the comfort of their own home, even with pajamas on, and get approved quickly without moving off the couch.

Fintech lenders approve a borrower’s credit worthiness and automate the underwriting process. This operation allows fintech lenders to offer loans to more borrowers.

Payments

Companies in this category let people send money to each other without banks, avoiding excessive bank fees for simple pee-to-peer transfers.

Companies allow users to send and receive money quickly with little fees. Companies like PayPal, Cash App, and Venmo are examples.

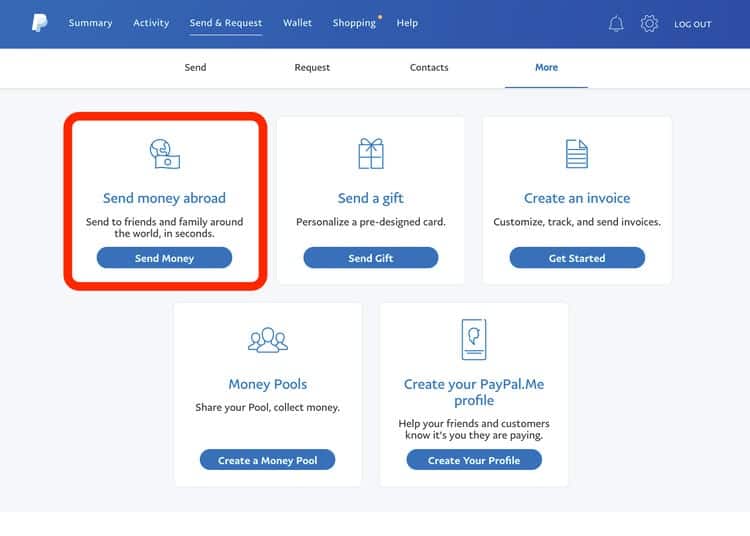

International money transfer

Transferring money through traditional outlets has always been expensive. Banks usually charge fees up to 8% to send money abroad. When transferring large amounts of money more than once to a loved one or friend, fees can add up quickly.

Along with the high fees, banks are usually slow when it comes to international transfers. Companies in this category offer faster, less expensive international money transfers. PayPal is a great example of this category.

Personal finance

In the past, the only way to receive personal financial advice was to go to a bank and talk to a financial advisor. And to maintain a budget, consumers often used lengthy spreadsheets.

Now, there are a variety of apps that can offer financial advice. Users can receive advice about their finances from almost anywhere and at any time. The app Mint is a good example of a digital service that helps with personal finance.

Equity financing

This category is making it easier for businesses to raise money. Some fintech companies connect people to investors, while others use a crowdfunding model to let anyone invest.

Fintech has simplified the fundraising process for businesses. Virtual fundraising is easier for investors, particularly because everything can be done online.

Consumer banking

Traditional banks charge customers high fees, so fintech companies that operate in this category present an alternative bank for consumers. Consumer banking companies target audience are usually people who can’t get approved with traditional services because of their credit.

Insurance

Financial technology companies also branched out to the insurance market. Fintech innovations dealing with insurance have the potential to deliver a wide range of benefits – in particular efficiency improvements, cost reduction, and greater financial inclusion. Companies are making use of new technologies to reach customers. This category is also more flexible than traditional insurers.

With the financial technology market expanding each year with new startups, everyone’s curious to know what’s next. Fintech is rapidly transforming the financial service industry, but how much is this change impacting our society? Some people are worried that this approaching revolution will force everyone to conduct business digitally, while others are concerned with their privacy, which is a huge issue today of how companies handle users’ data.

Fintech is made possible through data and efficiency. Apps use alternative data sources, such as utility bills and predictive information to understand their customers financial lives. Yet, the same data that is used to help users can also be used to hurt them if companies don’t handle data properly. Another huge turn-off for users can be apps charging hidden fees and having high interest rates.

Fintech certainly has potential to expand to more categories, but there’s no chance it will replace banks and take over. This is where the story turns, because the growth of fintech companies is great for some banks. Fintech companies need banks such as Bank of American and Citibank to manage the accounts of each user of an app. Banks make money based on the number of transactions. They also issue debit and credit cards for fintech companies. For example, Cash App uses Sutton Bank to issue their debit cards while their direct deposit feature is being powered by Lincoln Savings Bank.

Sometimes there’s a need for human-to-human communication when it comes to finance. Look at fintech as an extra tool added to the toolbox of the banking industry, making our tomorrow more efficient.