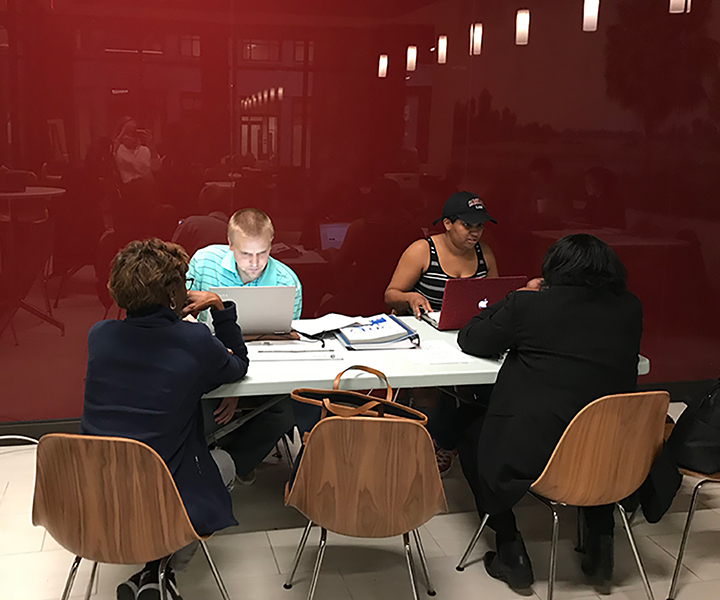

A group of taxpayers wait to be interviewed by USC law students to determine their eligibility for the Volunteer Income Tax Assistance program.

In the second phase of their volunteer efforts, USC law students meet one-on-one with taxpayers to assist with the tax forms.

Tanya Witten, a Columbia resident getting tax assistance, laughs about how her mom used to be the one who helped her with taxes.

The University of South Carolina Law School is offering tax filing assistance to Columbia residents who are elderly, disabled, non-English speakers or who receive limited income throughout the month of March.

The program is a branch of the VITA Program, otherwise known as the Volunteer Income Tax Assistance. The program is sponsored by the IRS and is a pro bono opportunity for IRS-certified law students to help people in the community and gain work experience.

“I guess you can say I just like the challenge of doing taxes,” said Cooper Melvin, a volunteer with the VITA program and law student at USC. This is Melvin’s second year with the VITA program. His first year volunteering was through the University of Alabama as an undergraduate.

The events typically run as such: once you arrive, you sign a check-in sheet and wait in the café to speak with a student. An IRS-certified student will then interview you to determine what kind of tax forms you’ll be filing.

From your initial interview, you would meet one-on-one with another volunteer, who takes care of the majority of the work. They organize and prepare your taxes.

The last step of the process is to meet with the event supervisor, a tax coordinator who checks over everything the law student has completed before filing the taxes.

Tanya Witlen, a potential VITA program participant, was hopeful and excited for her tax assistance. In years prior, she emphasized how her mother had always helped her with her tax filing. With Witlen’s first year of post-college employment under her belt, she was ready to learn from the students.

“My friend has volunteered with VITA before, and told me how great it was and how she was able to gain this lifelong skill. So I’m hoping to learn alongside,” said Witlen.

USC has been participating in this IRS-sponsored program for 25 years. When the program was originally implemented, everything had to be done by hand. Today, everything is done on a computer and with a Cloud. While the methods of filing taxes may have changed, the help volunteers provide is still far-reaching.

Columbia residents can visit the USC Law School, on Senate Street, Wednesday evenings from 5:30 to 8 p.m. and Saturday mornings from 9 to 11 a.m. to receive tax assistance. The event is held in the café on the first floor of the school. In order to receive tax assistance, applicants must have a valid photo ID, a Social Security Card for the filer and all dependents and all tax documents.

The IRS has announced that Tax Day will be Tuesday, April 17, this year.